Making the deposit of the refund check which you received from the vendor Third Scenario When the vendor sends you a refund check on behalf of another vendor Now, set your preferred credits with ‘Set Credits’, and then apply ‘Bill Credit’ which you created earlier.

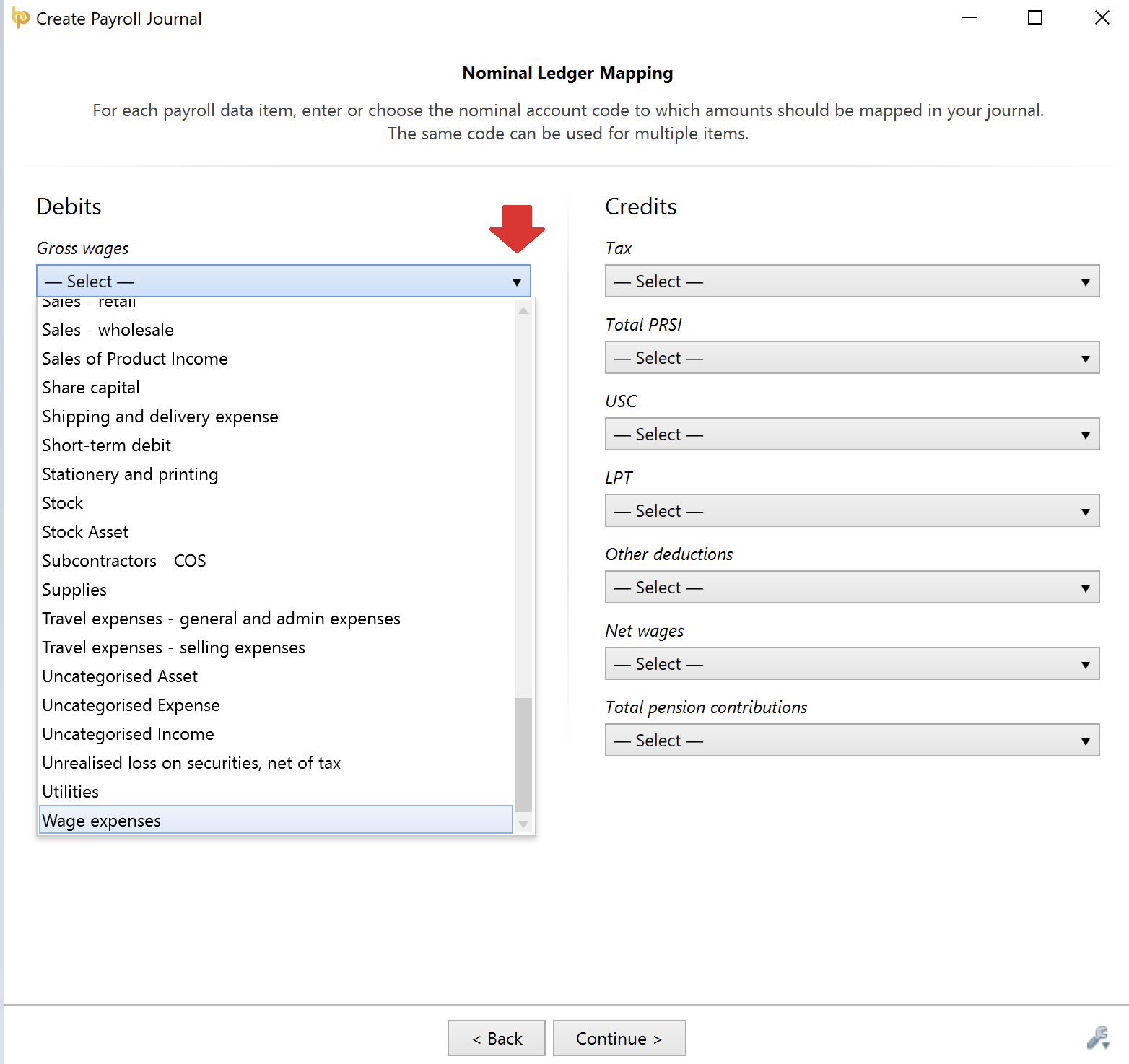

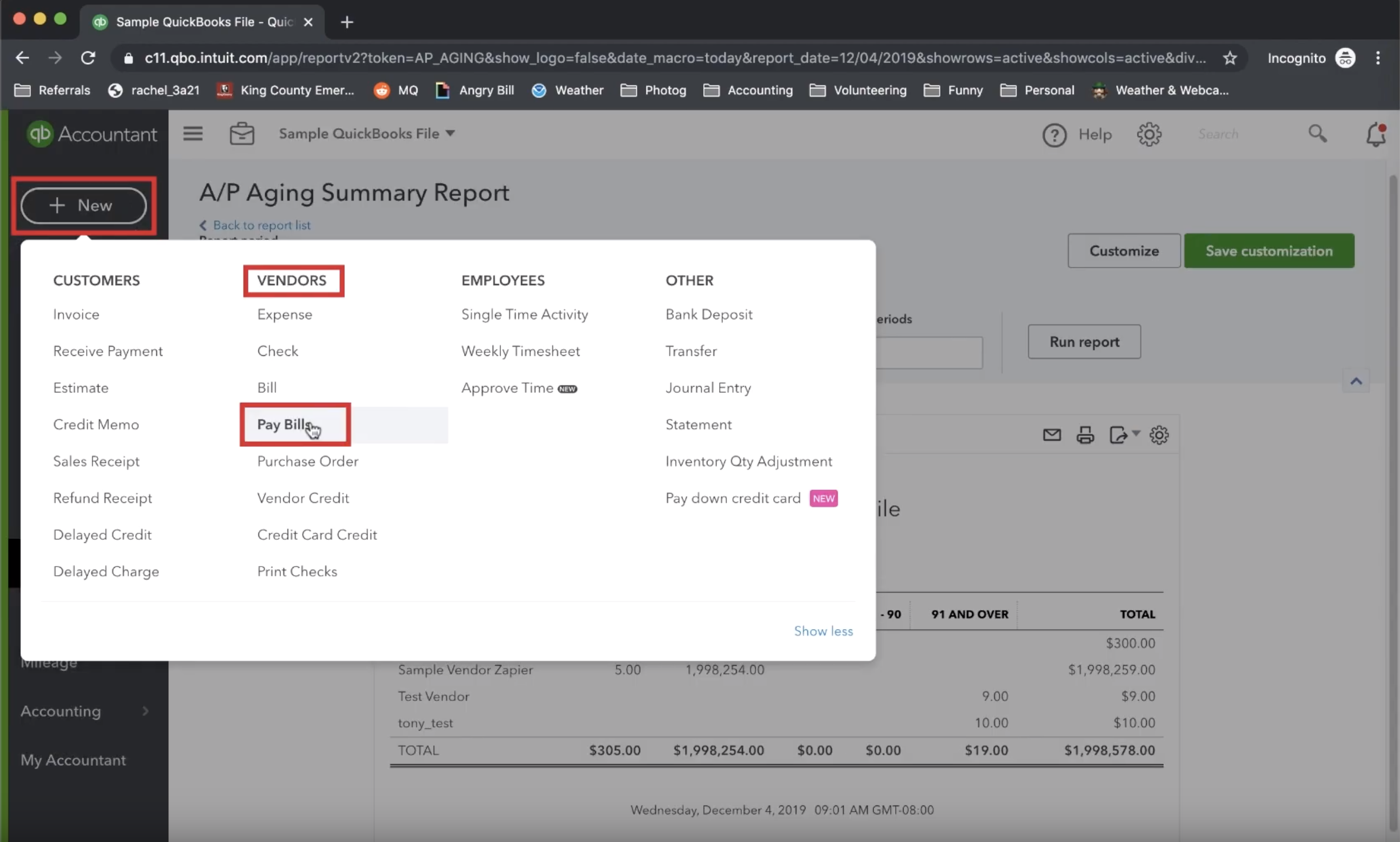

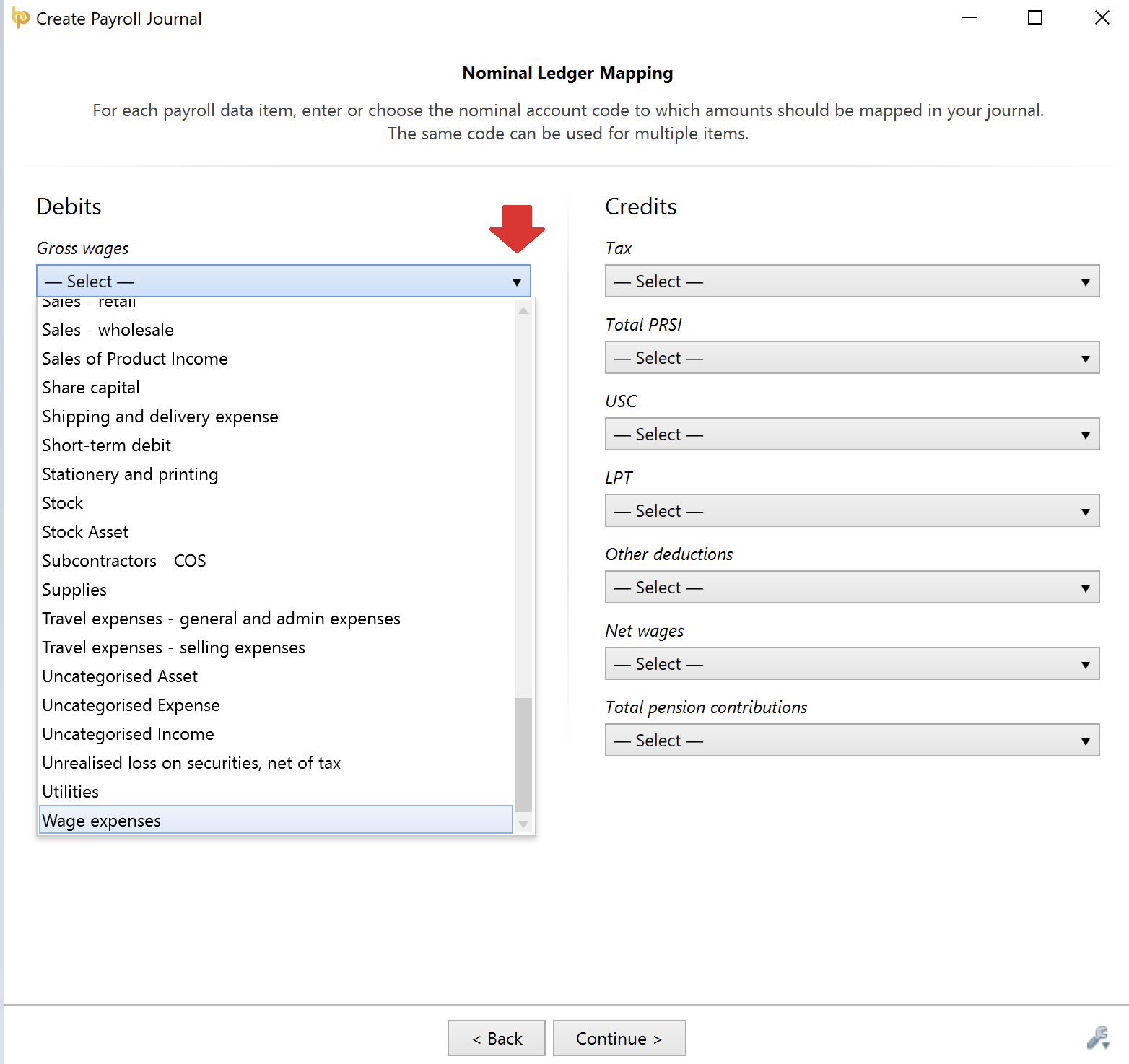

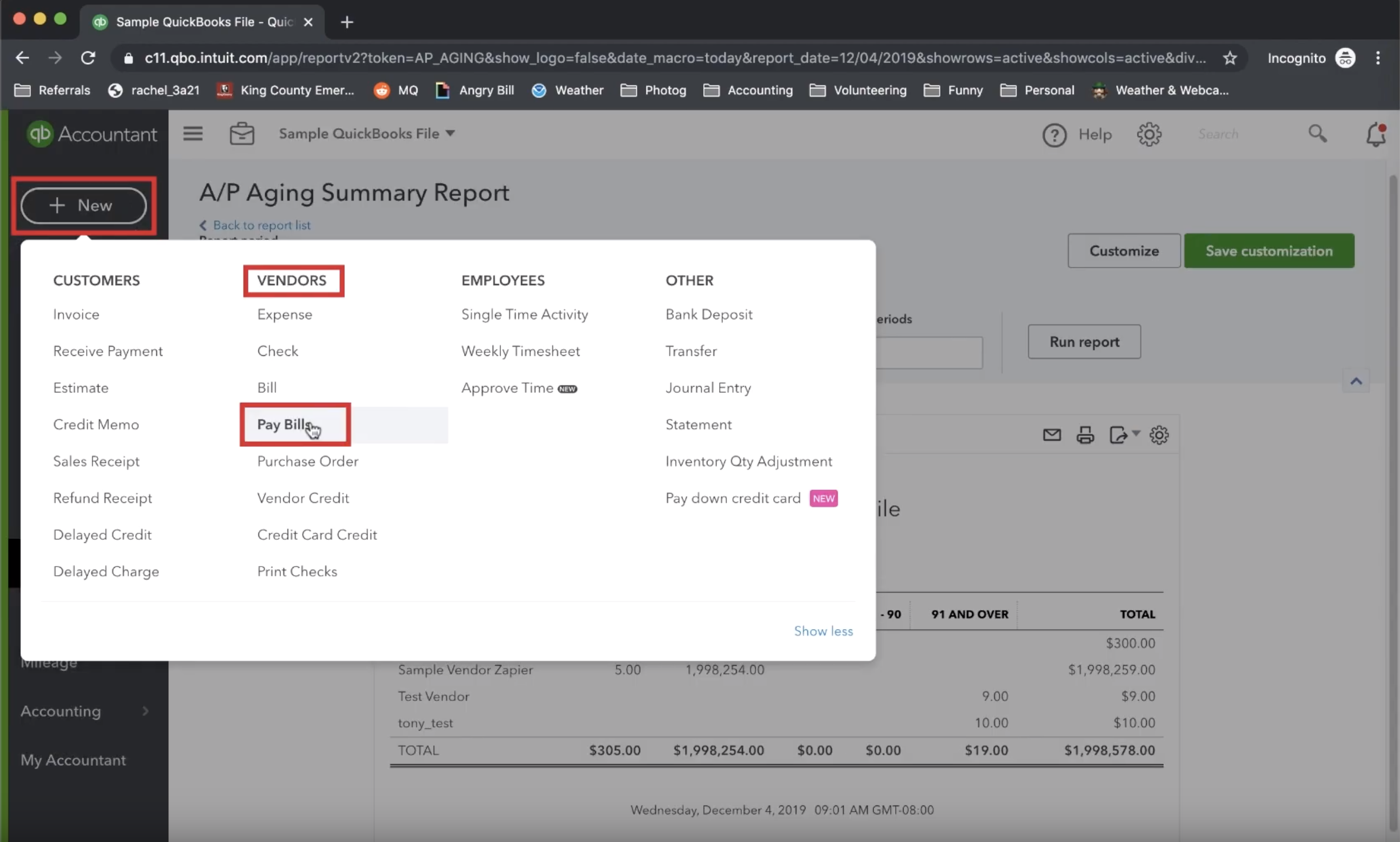

And, finally, save all the details and close the window. Now, in the account section, enter the exact amount which you received in the form of a refund from the vendor. Fill up the account details which are showing on the original bill. After that fill up the ‘Vendor Name’ and then click on ‘Expense Tab’. For the return of goods choose the ‘Credit option’ from the account. For this, go to the ‘Vendor Menu’ and select ‘Enter Bills’. Recording for the refunded amount by bill credit At last, click on ‘Save and Close’ and close the window. Fill in the exact amount you received from the vendor refund. Now you are account window and from the account drop-down list select the ‘Payable Account’. After that choose the received option from the drop-down list and select the name of the ‘Vendor’ from whom you received the refund. For this, you have to go to the banking menu and from there click on ‘Make Deposits’. Second Scenario When the vendor sends you a refund check for a paid bill Now, in the final step click on done and then select ‘Pay Selected Bills’, and you are done, once you click on done. Now, set your preferred credits with ‘Set Credits’, and then apply them to ‘Bill Credit’. After that carefully review the ‘Deposit’ amount with the help of ‘Vendor Check Amount’. For this, you have to go to the ‘Vendors’ menu and from there select ‘Pay Bills’. Now, enter the exact amount you received from the vendor, after that click on ‘Save and Close’, the window will be closed and saved with your recorded data. Then record the ‘Vendor Name’, and then click on ‘Items’. For this, you have to select ‘Enter Bills’ from the vendor menu, after that click on ‘Credit’. Now, enter and fill up the required details in ‘Deposit Account’, and at last click on the ‘Save and Close’ option, it will close the window with all the details saved.įor returned items, recording a bill credit. After that, select your ‘ Account Payables’ account, then in the account column, record the exact amount you received from the vendor in ‘Vendor’. Now from ‘Received’ click on that and it will open as a ‘drop-down list’, from there select the name of the vendor who sent you the refund. For this, you have to go to the ‘ Banking Menu’, after that select ‘Make Deposits’, then click on ‘OK’ in the deposit window.

And, finally, save all the details and close the window. Now, in the account section, enter the exact amount which you received in the form of a refund from the vendor. Fill up the account details which are showing on the original bill. After that fill up the ‘Vendor Name’ and then click on ‘Expense Tab’. For the return of goods choose the ‘Credit option’ from the account. For this, go to the ‘Vendor Menu’ and select ‘Enter Bills’. Recording for the refunded amount by bill credit At last, click on ‘Save and Close’ and close the window. Fill in the exact amount you received from the vendor refund. Now you are account window and from the account drop-down list select the ‘Payable Account’. After that choose the received option from the drop-down list and select the name of the ‘Vendor’ from whom you received the refund. For this, you have to go to the banking menu and from there click on ‘Make Deposits’. Second Scenario When the vendor sends you a refund check for a paid bill Now, in the final step click on done and then select ‘Pay Selected Bills’, and you are done, once you click on done. Now, set your preferred credits with ‘Set Credits’, and then apply them to ‘Bill Credit’. After that carefully review the ‘Deposit’ amount with the help of ‘Vendor Check Amount’. For this, you have to go to the ‘Vendors’ menu and from there select ‘Pay Bills’. Now, enter the exact amount you received from the vendor, after that click on ‘Save and Close’, the window will be closed and saved with your recorded data. Then record the ‘Vendor Name’, and then click on ‘Items’. For this, you have to select ‘Enter Bills’ from the vendor menu, after that click on ‘Credit’. Now, enter and fill up the required details in ‘Deposit Account’, and at last click on the ‘Save and Close’ option, it will close the window with all the details saved.įor returned items, recording a bill credit. After that, select your ‘ Account Payables’ account, then in the account column, record the exact amount you received from the vendor in ‘Vendor’. Now from ‘Received’ click on that and it will open as a ‘drop-down list’, from there select the name of the vendor who sent you the refund. For this, you have to go to the ‘ Banking Menu’, after that select ‘Make Deposits’, then click on ‘OK’ in the deposit window.

Methods to record a vendor refund in quickbooks First Scenario When the Vendor sends you a refund check for the returned inventory itemsįor recording deposit of the vendor check –

When the vendor sends you to refund as credit card credit. When the vendor sends a refund check which is not related to the existing bill. When the vendor sends you a refund check on behalf of another vendor. When the vendor sends you a refund check for a paid bill. When the Vendor sends you a refund check for the returned inventory items. Methods to record a vendor refund in quickbooks. #How to code personal expenses in quickbooks how to

We are going to learn how to record a vendor refund in QuickBooks for all the above mention scenarios. The vendor can send you a refund check for the returned inventory items, the vendor can send you a refund check for a paid bill, the vendor can send you a refund check on behalf of another vendor, the vendor can send you a refund check which is not related to the existing bill, and the vendor can send you to refund as credit card credit. Now, it’s interesting to know that what type of vendor refund do you want to record? Here are some types of refunds that the vendor can send you. So, now we know how to treat vendor refunds but we still don’t know how to record vendor refunds in QuickBooks? This article is going to majorly focus on this particular topic so that you can record a vendor refund in QuickBooks by yourself. Vendor refunds are not income, you should always treat vendor refunds as a credit in a way that it will be adjusted with the original transactions which you did from your account. Getting a refund from a vendor? And having trouble with how to record it into your QuickBooks? Many of us are still confused, is the vendor refund credit or an income?

0 kommentar(er)

0 kommentar(er)